Cost Segregation Study: Multiple Property Class Analysis (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Estimated tax benefit analysis.

- Accelerate depreciation.

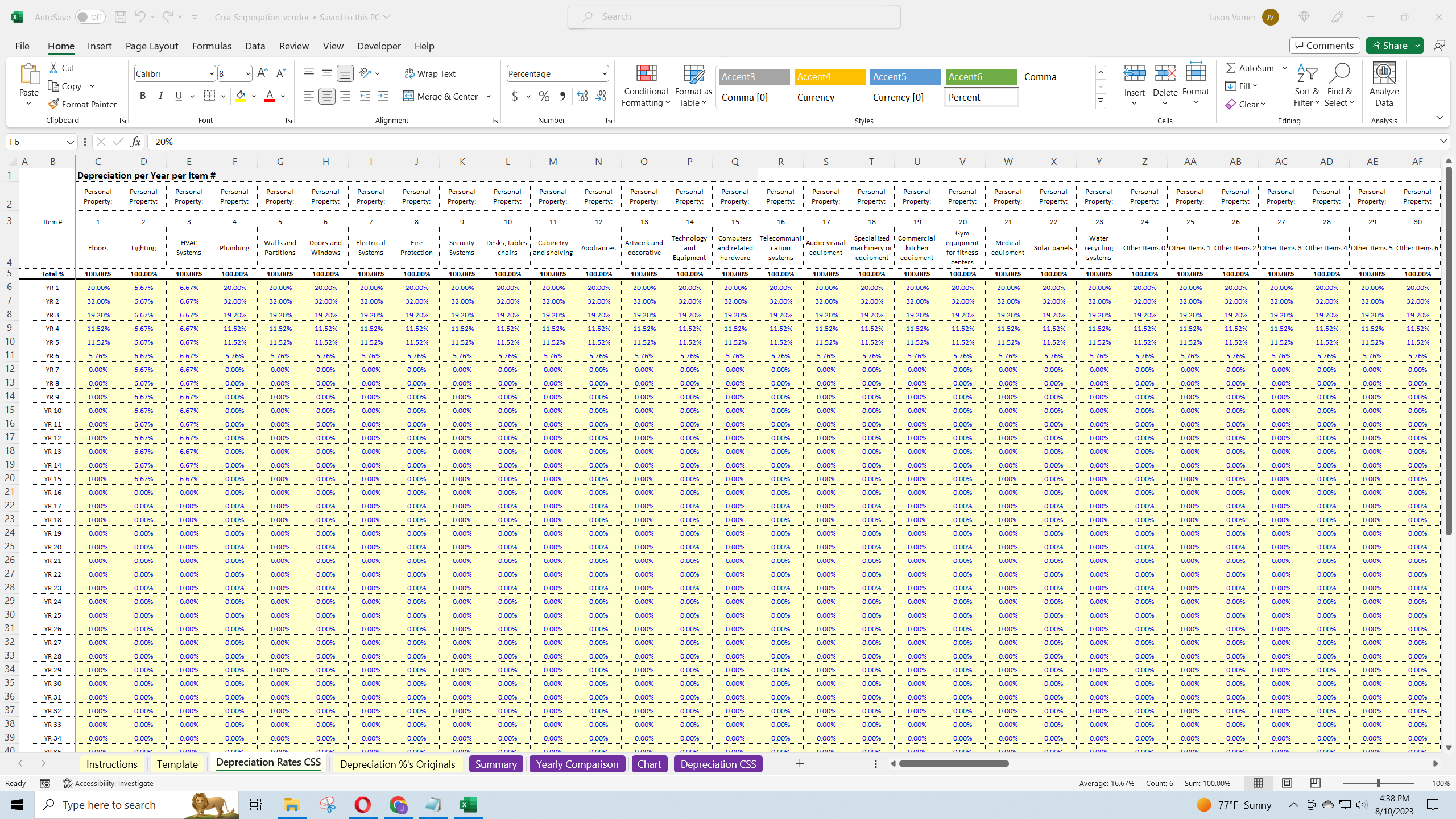

- Robust input schedule and depreciation inputs per year.

REAL ESTATE EXCEL DESCRIPTION

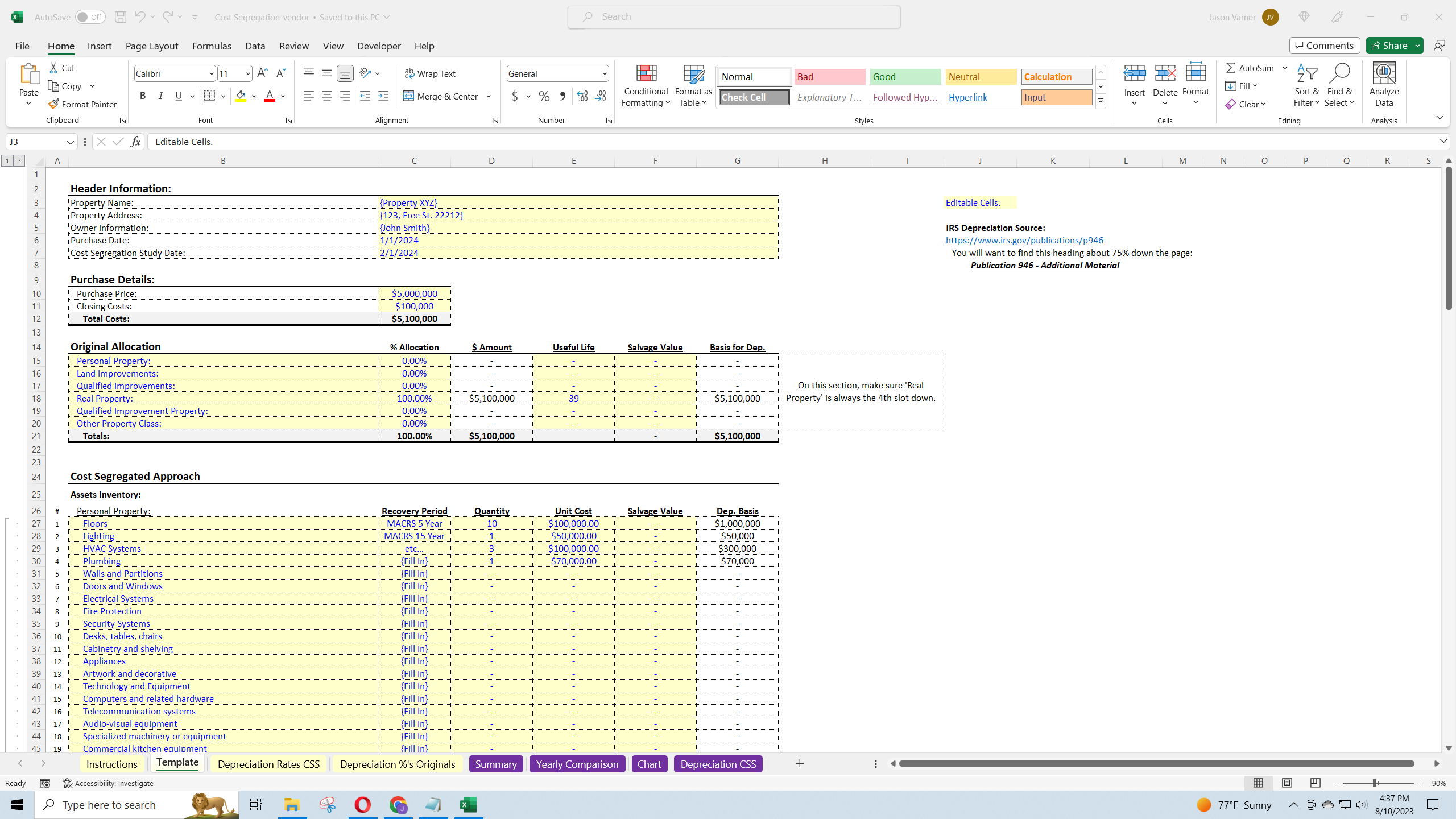

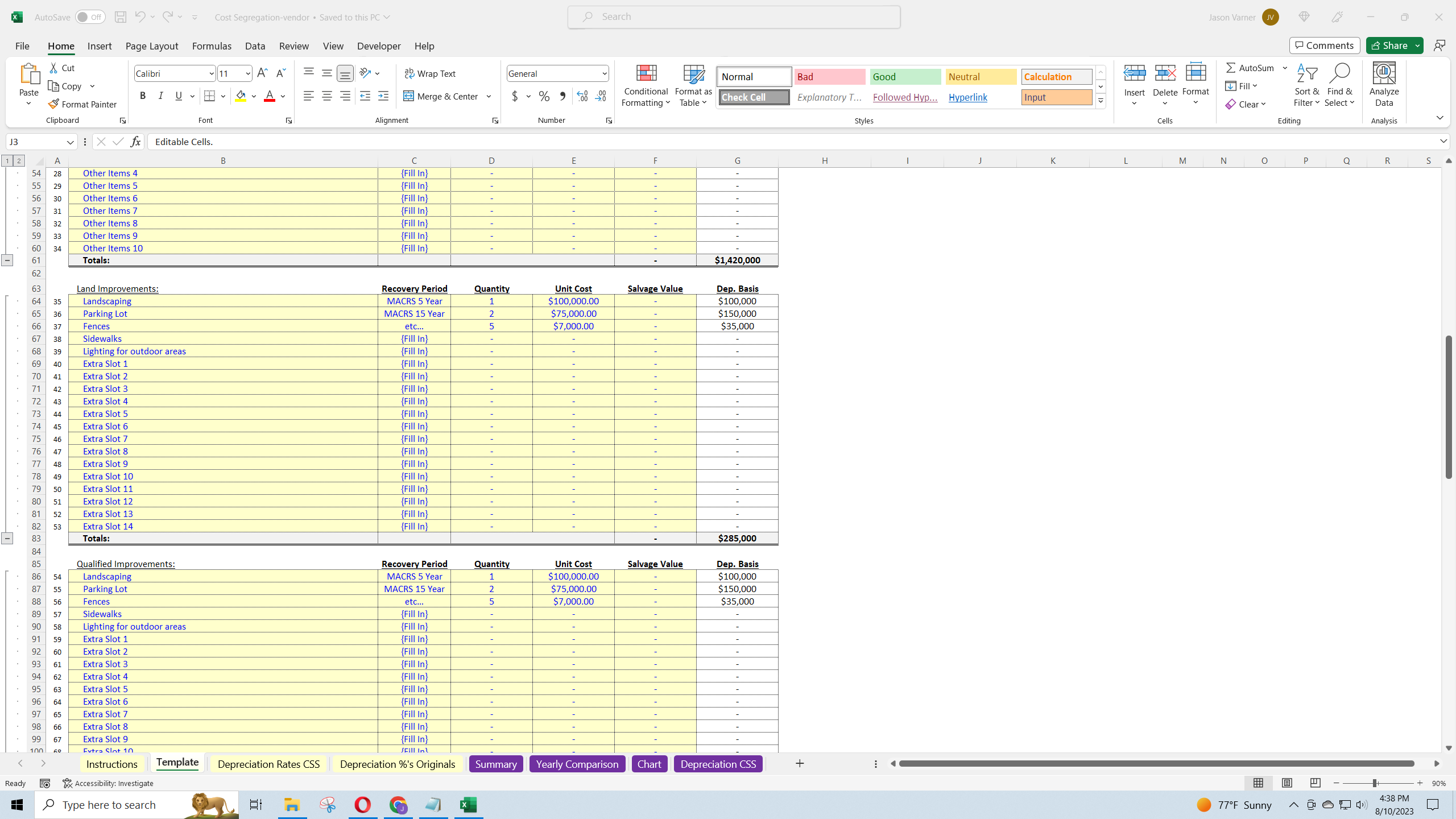

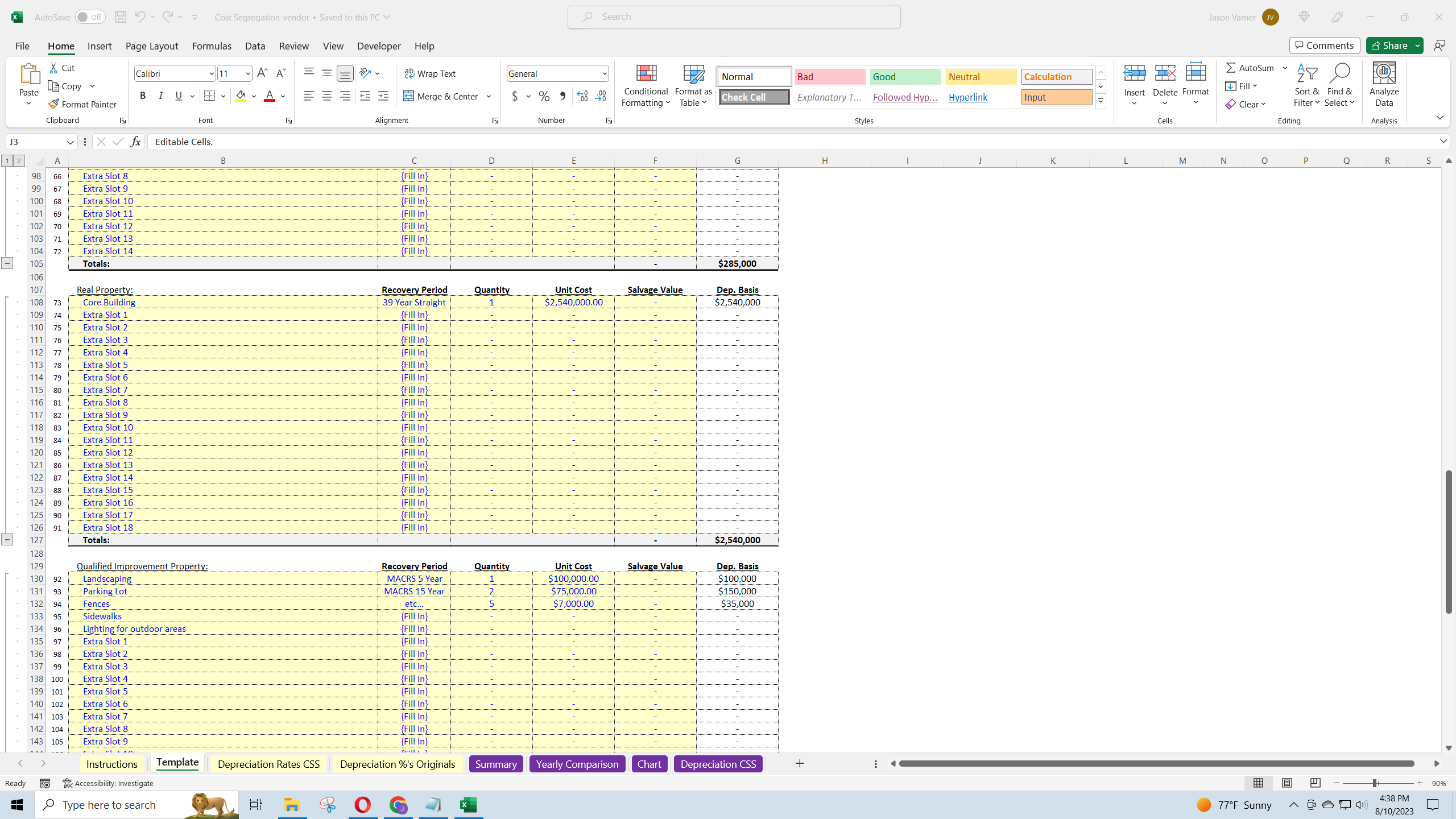

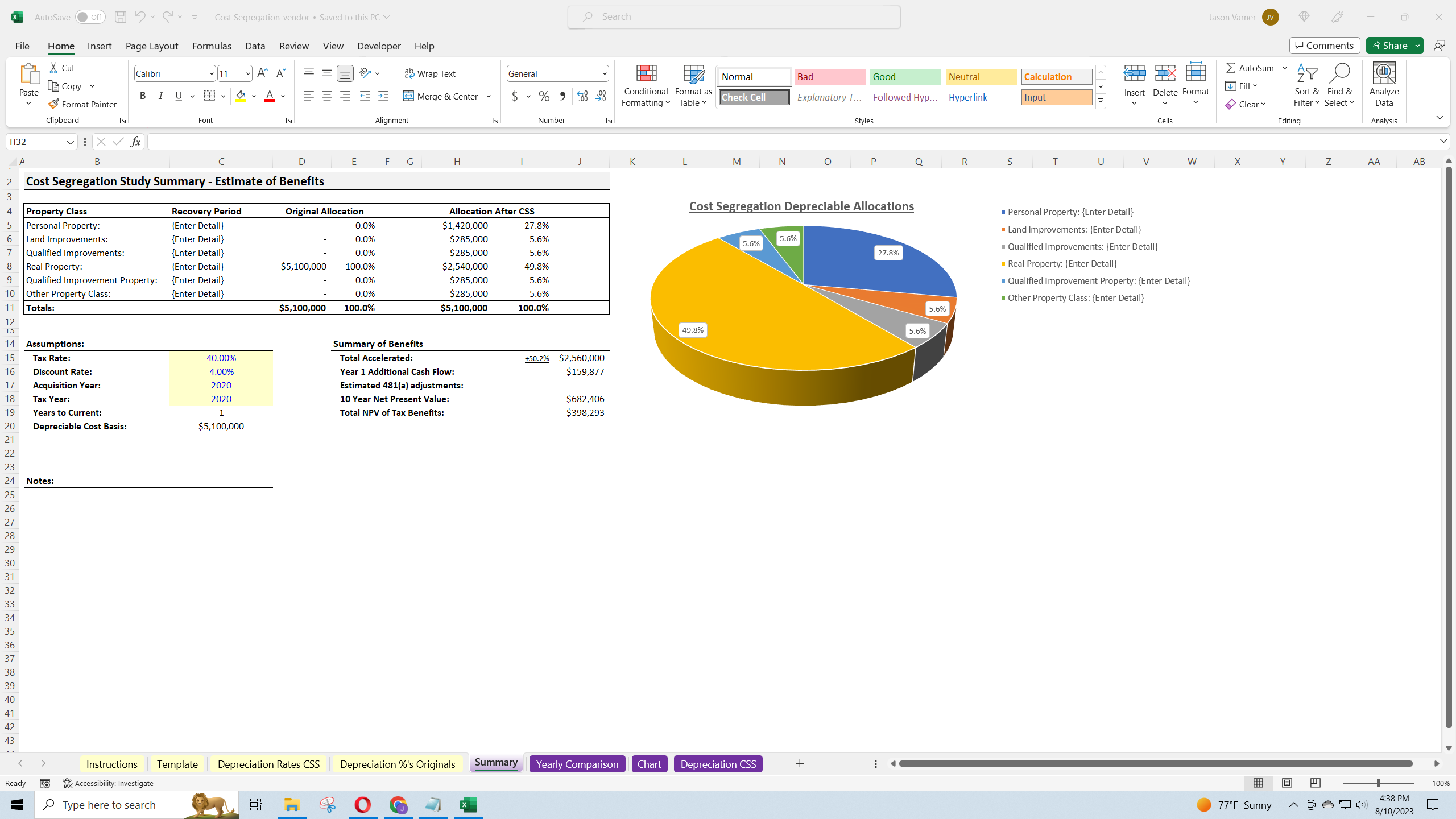

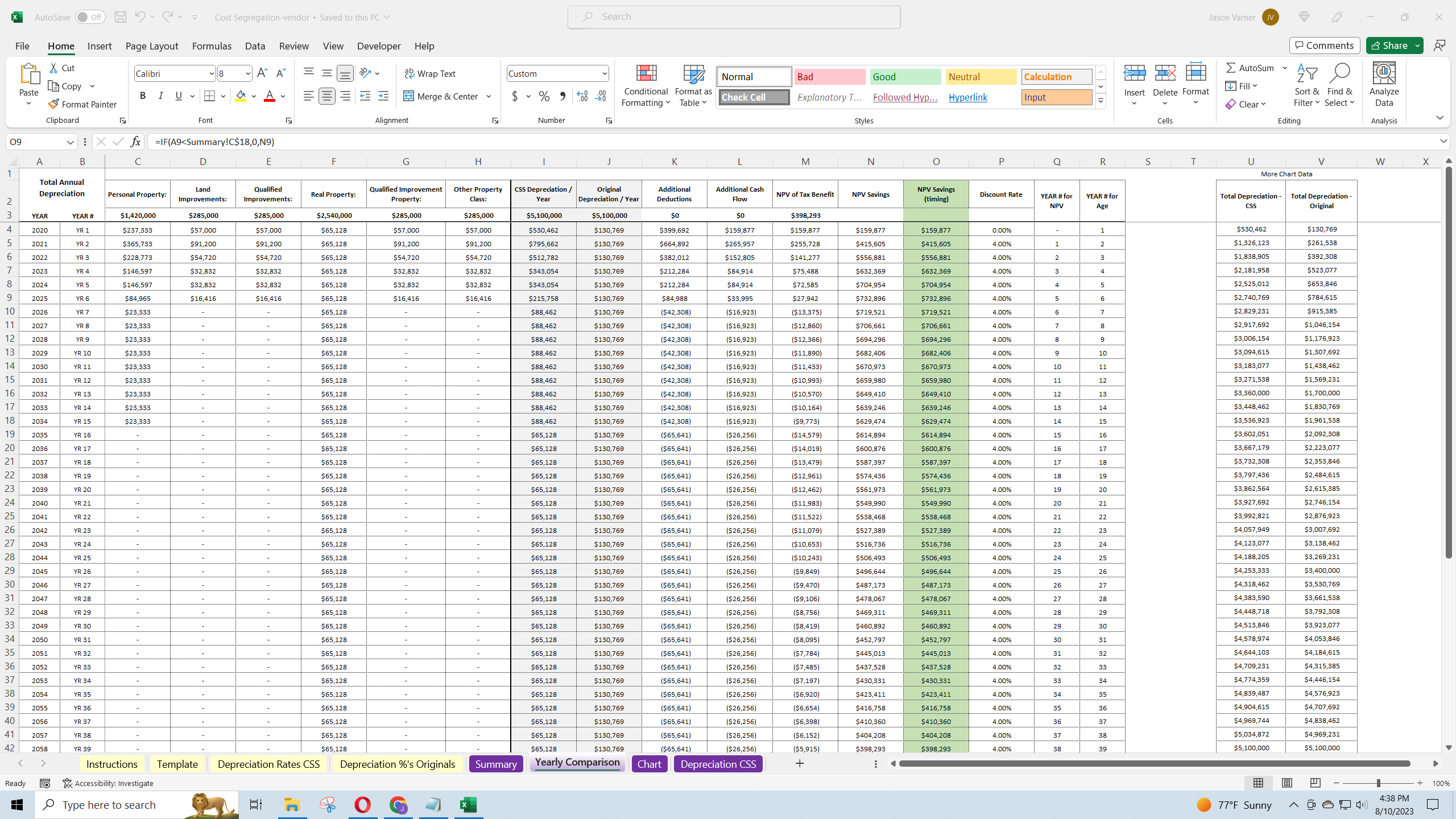

Accountants, accounting firms, and real estate property owners can all benefit from this cost segregation study (CSS) template. It makes the estimated benefit easy to figure out and has flexible assumptions for high level or detailed segregation analysis. You get a summary of cost allocations before and after as well as a yearly comparison of the tax benefit of doing the cost segregation vs not doing it.

A cost segregation study is just something any property owner can do under the IRS tax laws to accelerate some of their depreciation after the purchase of a building. It can only be done once per building owner, and it can be done the year of purchase or many years after you purchased the building. Normally firms are hired to perform this analysis and pricing can range anywhere from $5k to $15k. However, you can do it by yourself if you're feeling brave.

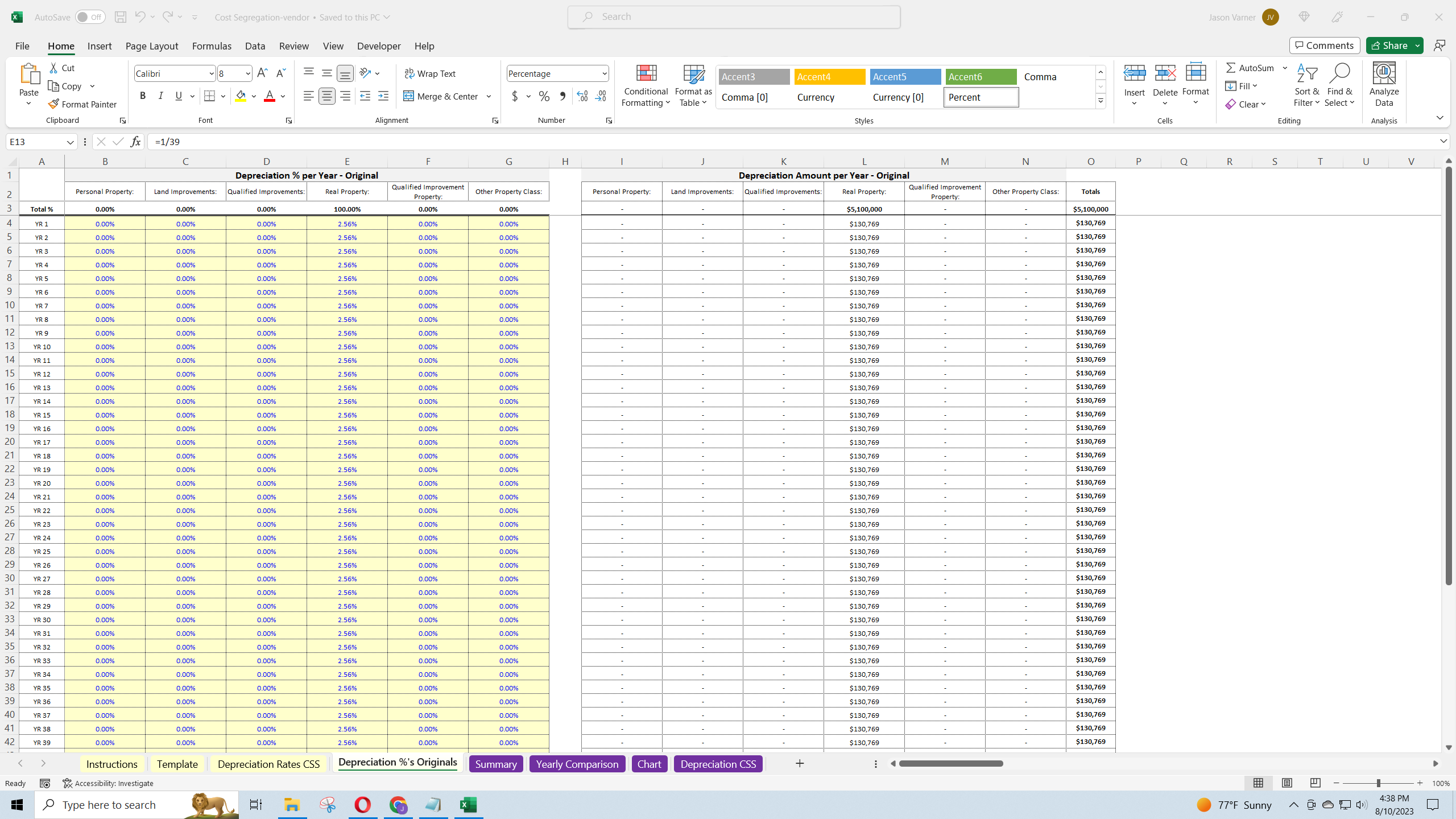

All that is happening in the CSS template is instead of depreciating the entire building purchase with straight-line depreciation, you are segregating out things from the purchase such as personal property, land improvements, and other cost basis items that went into the purchase of the building that have a faster depreciation schedule (possibly 3,5,7,10,15, 20 years) or what have you per the IRS recovery period categorizations. By accelerating depreciation expenses, you can gain a greater tax benefit now. Because of the time value of money, that becomes a real cash flow benefit because you can use the cash to invest or do whatever you want with instead of having to wait for the tax benefit over the entire straight-line depreciation schedule that buildings are normally subject to (27.5, 30 or 39 years typically).

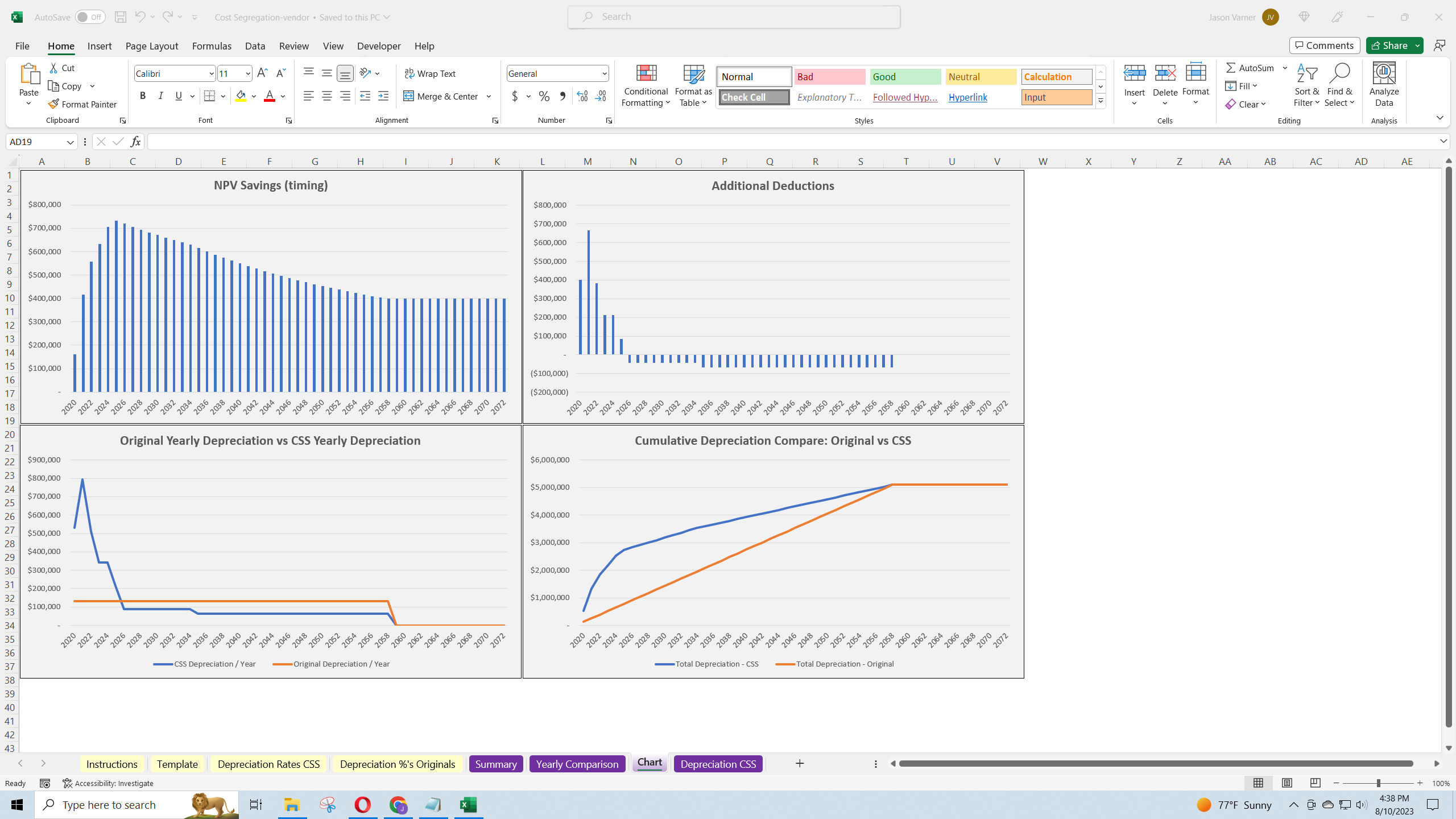

The model will show you the estimated year 1 cash inflow as well as the 10-year net present value of performing the study.

Instructional video included in the file download on the 'Instructions' tab.

This template includes detailed input fields for various property categories, allowing for precise customization. Charts and graphs are provided to visualize depreciation schedules and cash flow benefits, making the analysis straightforward.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate Excel: Cost Segregation Study: Multiple Property Class Analysis Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Real Estate Underwriting Templates / Deal Analyzers

This bundle contains 31 total documents. See all the documents to the right.